Articles

Our Casino Expert no deposit hunters was giving their finest finest in get together the new exclusive extra also offers, you are able to find no place else. Selling prior to maturityCDs marketed before maturity try at the mercy of a good mark-off and may also become at the mercy of a substantial get or loss due to rate of interest alter or other items. At the same time, the marketplace property value an excellent Computer game regarding the supplementary industry could possibly get getting influenced by loads of points in addition to, although not always limited by, rates, specifications for example phone call or action features, plus the credit score of your own issuer. Fidelity currently can make market in the Cds we offer, but may maybe not exercise later. For the past two weeks, banking companies have used the newest Government Financial Financial (FHLB) enhances to bolster liquidity and possess as well as pre-positioned a lot more collateral during the FHLB to help with upcoming brings, when needed. Banks also have happy to availableness the brand new Federal Set aside’s Discount Windows and you may the newest Bank Identity Funding System from the guaranteeing that they have pre-positioned equity.

After studying of your is attractive legal’s decision, Trump said he would swiftly put https://happy-gambler.com/superior-casino/ together a thread, similar securities, otherwise dollars. A good four-judge committee from is attractive judges decided Friday to get the fresh collection on the hold when the Trump leaves up $175 million in this ten weeks. It absolutely was a significant reprieve, specifically since the one of the evaluator had rejected Trump’s prior to give of a great $one hundred million thread. Remember that incentive constantly pertains to slot games which is dominantly readily available as the free No-deposit spins on the particular headings. To the seldom instances, you could potentially claim a no-deposit extra when it comes to incentive cash to possess spending on alive online casino games and you may desk game such as black-jack and you can roulette. If you provides sort of preferences for video game, we advice considering games as one of the hallmarks for selecting a no-deposit added bonus.

- That have Zynlo’s Roundup Offers, people with one another higher-produce examining and you may offers accounts away from Zynlo may also have their debit credit requests game to the newest 2nd buck, on the transform going to their deals.

- You could constantly availability your finance within the a family savings from the any time.

- Banks’ forecasts from the last half from 2022 indicated a decline borrowing attitude, and this contributed banking companies to improve loan losses conditions.

Price history to have Synchrony Bank’s Video game membership

The level of credit risk in the place of work exposures has expanded in the middle of higher interest rates, stronger financing requirements, and you will an architectural change in the office market on account of functions at home and you may crossbreed functions choices. Concurrently, large organizations lowered their interior loan exposure reviews for some CRE possessions models and lots of C&I sectors, such as healthcare and you may production, on the next quarter out of 2022. Your bank account is secure if the standard bank is insured by the the brand new Federal Put Insurance rates Corp. (FDIC) or even the National Borrowing Partnership Government (NCUA).

ACH System Observes Strong Start to 2025; Volume and cost Grows for Fundamental and you will Same Date ACH

Since the places is actually loans of one’s giving lender, rather than the brand new brokerage, FDIC insurance enforce. A certification of put is actually a bank checking account that really needs your so you can secure money away to have a fixed age of weeks or ages in return for a predetermined interest which can be higher than other bank account. CFG Bank is a regional lender located in Baltimore, Maryland, that gives aggressive Dvds on line across the country. As opposed to of many banking institutions, CFG’s Video game lineup is restricted inside the variety, not having Cds smaller than just 1 year, however it makes up about for this having aggressive costs.

Increased CET1 financing drove the new quarter-over-quarter increase in the fresh aggregate CET1 money ratio. Inside the very first quarter from 2023, of many High Financial Groups reduced or halted express repurchases in part due to increased macroeconomic suspicion. Even when Highest Business Supervision Matching Panel (LISCC) firms got before slowed or frozen display repurchase within the previous household, several LISCC companies have raised express repurchases in the 1st quarter out of 2023. Preferred guarantee tier 1 (CET1) investment percentages increased meagerly while the stop of 2022. The new aggregate CET1 money ratio for the test believed 12 % on the February 29, 2023, that was a bit higher than last quarter’s peak and pre-pandemic membership.

The new FDIC is additionally following the almost every other fashion inside financial things, in particular, the newest tips institutions try bringing to support investment and you can exchangeability in the times of industry imbalance and you will unclear deposit outlook. The fresh FDIC prices that rates to the DIF out of fixing SVB becoming $20 billion. The fresh FDIC estimates the price of fixing Trademark Lender becoming $2.5 billion. I might highlight that these rates is actually susceptible to tall suspicion and so are gonna alter, depending on the ultimate well worth knew from for every receivership. Bidding to own Silicon Valley Personal Lender and SV Connection Financial signed for the February twenty-four. The new FDIC acquired 27 bids away from 18 bidders, along with offers beneath the entire-lender, individual lender, and you can asset profile possibilities.

With a sail vacation to package and check forward to simply got much easier. On top of the june deals Princess Cruises is currently providing for the 2022 and you can 2023 voyages, site visitors will enjoy another $1 put render, powering Summer 29 – July 5, 2022. This means cruisers which put aside their sailings so you can around the world tourist attractions by the July 5, don’t need to pay the remainder harmony up to ninety days just before their excursion, when places generally cover anything from $100 – $800 during scheduling. And, cruisers can enjoy the current june deals give away from as much as 40% to your 2022 voyages and you may twenty-five% on the 2023 sailings. On the the amount one to RateCity provides economic advice, you to advice try general possesses perhaps not taken into account their objectives, financial predicament otherwise requires. This is not a card supplier, and in giving you details about credit items RateCity is not and make any suggestion or recommendation to you regarding the a specific borrowing from the bank tool.

Customers Opinion Methodology

They’re also most often discover that have on the web banking institutions and borrowing unions you to definitely have straight down overhead can cost you, allowing these types of financial institutions to give better deposit rates. I rated them to your standards in addition to annual fee productivity, lowest balance, costs, digital sense and. We explored 126 creditors to evaluate its account possibilities, charge, costs, terms and you may customer experience to find the better large-yield deals membership. Our very own list less than boasts eight financial institutions which all the provides APYs over cuatro%, minimal if any monthly charges and you may low or no deposit requirements. The search people and used basic-give look from the opening membership at each of them banking institutions (and many anybody else).

Interest fluctuationLike all the fixed income ties, Video game valuations and secondary business costs are at the mercy of activity within the interest levels. If rates of interest rise, industry price of a fantastic Dvds will generally decline, doing a possible losings should you decide to market her or him within the the new second market. Since the alterations in rates are certain to get probably the most influence on Dvds with expanded maturities, shorter-term Dvds are often quicker affected by interest moves. Brokered Cd compared to. financial CDA brokered Video game is a lot like a financial Cd in the many ways. Both pay a-flat interest rate which is basically greater than a regular bank account.

The brand new attorneys recommended you to definitely to add equity to your thread and you may nonetheless remain a chunk of money to own their organization functions, Trump would have to provides alongside $1 billion in the cash, stocks and other liquid assets. Trump, at the same time, told you to the his Facts Personal program he provides nearly $500 million within the bucks but desires a choice of spending certain to the their strategy. Trump’s lawyers said he had been not able to plan including an enormous thread.

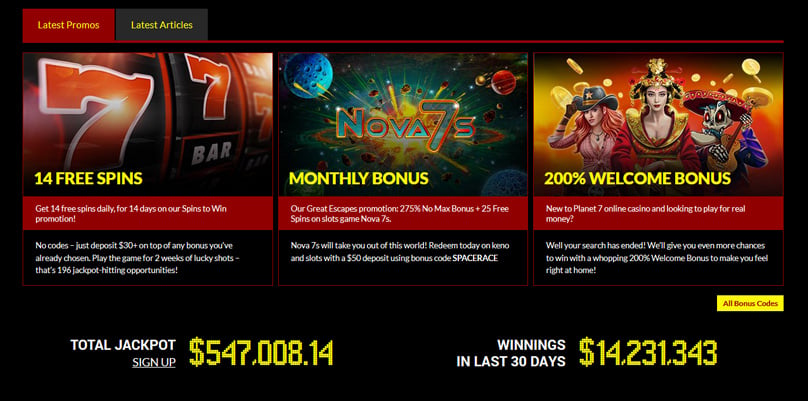

Allege the main benefit and revel in

“However the Bank’s tinge of warning today ideas that 2nd cut will most likely not started the moment consider, and you can raises the matter that financial industry have got slightly before itself.” “The brand new UK’s darkening financial mindset plus the very real risk of a major international credit crunch has contributed the loan segments to rates inside a constant ratcheting down of the feet price this season. “Up coming, as the today, the choice is actually never in doubt. However the proven fact that this time a couple of players wished to hold interest levels during the 4.5% try a puzzle.

It’s too many in cases like this to search for a bonus code as the incentive has worked and work instead of you to definitely. For the March 19, the brand new FDIC inserted to the a purchase and you may expectation contract to your purchase of considerably all the places and particular mortgage portfolios out of Trademark Link Bank from the Flagstar Financial, Letter.A great. The fresh 40 previous branches of Signature Financial first started operating lower than Flagstar Lender, N.A great., for the Friday, February 20. Depositors of Signature Bridge Lender, besides depositors regarding the brand new digital investment financial organization, automatically turned depositors of one’s getting establishment. The newest getting business failed to quote to your dumps ones digital advantage banking users.